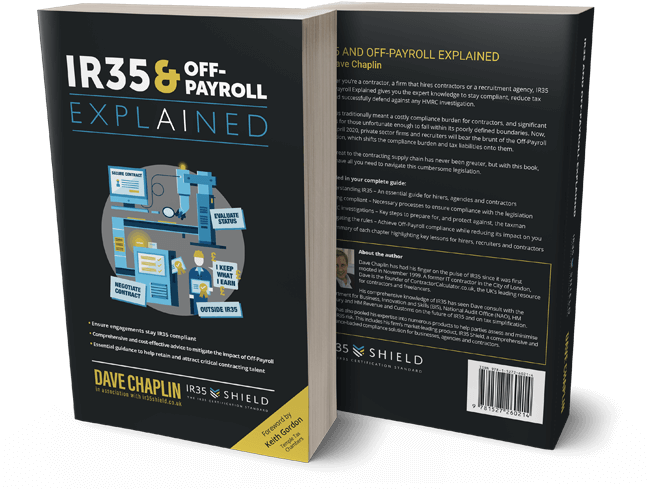

IR35 & Off-Payroll Explained

Transform the way you tackle IR35 compliance. Introducing a groundbreaking way to engage directly with our expert knowledge through a conversational AI, helping you manage your workforce while staying IR35 compliant.

Try our GPTAbout the GPT Book

IR35 & Off-Payroll Explained is now more than just a book; we’ve harnessed AI to make it an interactive experience. Ideal for contractors, firms hiring contractors, and recruitment agencies, this GPT version is here to help you learn how to remain compliant, reduce tax risks, and handle HMRC investigations – all through a conversational, AI-driven format.

Gone are the days of cumbersome navigation through dense text. With Dave Chaplin's insights and expertise, you now have a chatbot that can answer your questions about IR35 and off-payroll. Written in 2020 but still relevant today, the book helps businesses and contractors navigate the significant shift in compliance burden and tax liabilities post-April 2021.

Harness the power of AI to navigate this complex legislation, with helpful guidance at your fingertips.

How our chatbot can help

Understanding IR35

Directly ask and learn about the essential aspects for hirers, agencies, and contractors.

Staying compliant

Interactive guidance on processes to ensure adherence to the legislation.

HMRC investigations

Get personalised steps to prepare for and shield against tax inquiries.

Navigating the rules

On hand to help achieve compliance while minimising its impact on your operations.