The Small Consultancies Guide to IR35 - 3 essential steps to maximise value

How contractors can grow a small consultancy and adhere to IR35 compliance to maximise the sale value.

Need a robust compliance-led solution which is far superior to HMRC’s Check Employment Status for Tax tool? Get your free consultation to find out how IR35 Shield exceeds CEST in every way.

000,000 assessments

Meet with a consultant who will understand the needs of your business.

Over 00 years of experience

We will share insights and advise you on best practice for compliance.

0000 UK's first IR35 status tool

Answer any questions you may have and show you how IR35 Shield can fit your business.

Need some more info? View our plans

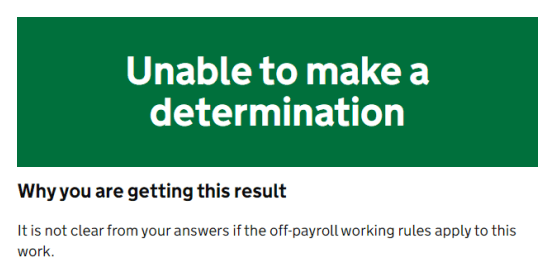

If you've used HMRC's CEST tool to determine an Outside IR35 status, flaws in the tool may put you at risk of not adhering to reasonable care. Use our simple checker tool to find out if you're affected.

Check your CEST IR35 result free

Uncertainty

Increased costs

Difficulties hiring contractors

Firms are experiencing uncertainty, increased costs to hire, and reduced access to the best contracting talent in the market.

Get your free consultationSome reasons CEST is widely considered as not fit for purpose are:

It’s for these reasons, and many more, that firms, contractors and insurance companies do not consider it a credible solution.

*The seminal decision of HMRC v Atholl House Productions Ltd [2022] EWCA Civ 501 published by the Court of Appeal on 26 April 2022 set precedent for many of the now-binding legal principles to determine tax status. The judges rejected many HMRC submissions which proved beyond doubt that their longstanding "policy view" on status matters, upon which CEST was built, was fundamentally wrong.

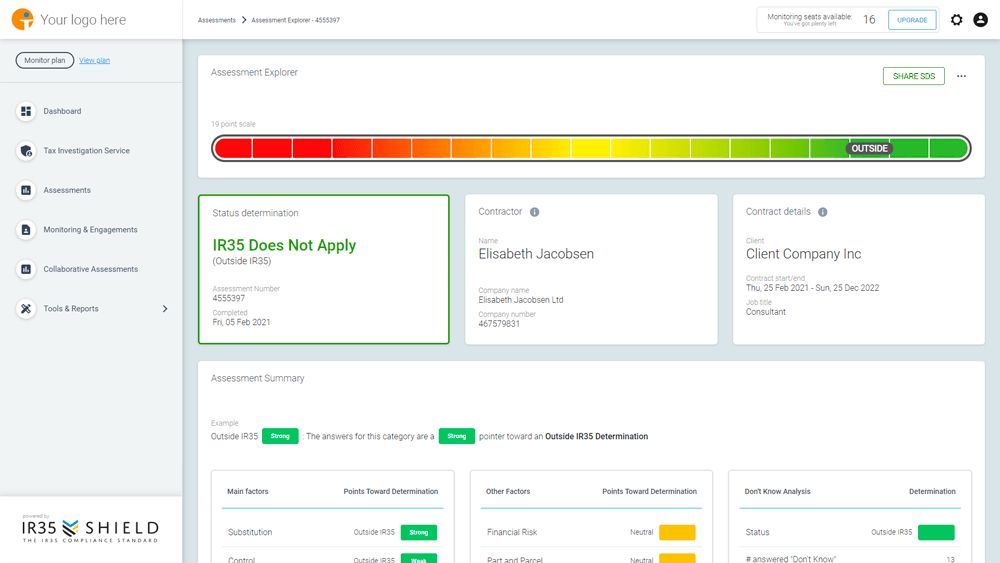

Get your free consultationThe old IR35 methods no longer apply in the new world of off-payroll. It’s critical to adopt a pre-emptive tax defence strategy, involving regular checks and gathering of evidence.

IR35 Shield foresaw this problem and provided an automated solution, giving confidence to clients and their contractors.

Get your free consultation| Features & Benefits | IR35 Shield | CEST |

|---|---|---|

| Automated assessments | ||

| Always available online tool | ||

| Scaled for business use (multiple users) | ||

| Encompasses current case law | ||

| Returns no indeterminate results | ||

| Automatically rechecks status | ||

| Collects evidence during the engagement | ||

| Customer support | ||

| Dedicated account manager | ||

| Access to legal expertise | ||

| Tribunal experience-led consultancy | ||

| SDS repository included | ||

| Flexible to suit your business | ||

| Allows Collaboration through the chain | ||

| Provides a detailed 25 page SDS | ||

| Gives independent, accurate results |

When HMRC challenge your IR35 compliance, our expert team is here to minimise your stress. With professional fees covered, we'll take care of the entire defence process and help resolve any investigation quickly.

Chat with an expert about our Tax Investigation Service

Don't just take it from us, listen to some of the reasons our partners recommend IR35 Shield.

“IR35 Shield saves us time, and its robustness leaves us comfortable in the knowledge that our workers have been assessed properly.”

Debbie Chinn

HR Advisor - PGA

“IR35 Shield ensures our assessment process is robust and compliant. The added benefit of Monitoring gives us peace of mind that potential tax risks arising during contracts are easily identified and resolved.”

Drew Horrocks

Head of UK TA Operations - Petrofac

“The assessment being weighted fairly across all factors gives us the confidence to reassure our clients that the outcome is correct.”

Katherine Miller

Head of Legal and Audit - La Fosse

IR35 Shield is powered by our expert assessment technology, built in 2009 and expertly refined along-side ever-changing UK IR35 case law. Our assessments deliver the same status as the judges rulings on all IR35 cases, giving you ultimate peace of mind.

We keep our finger on the pulse of IR35. You can trust our advice and guidance is always up to date.

The off-payroll rules apply only to contracts where either the client is a UK tax resident or the work is carried out in the UK...

Read moreThe IR35 reforms that came into effect in April 2021 do not affect small companies. Nonetheless, some small companies...

Read more