One of the biggest challenges of IR35 is that most parties involved in hiring contractors are still unaware of how it affects them. The legislation's complexity leads to misunderstandings, resulting in businesses unwittingly putting themselves at risk of not paying the relevant taxes.

This guide helps break down this often confusing situation into simple terms, giving you a clear understanding of who should actually be doing what. You will learn about the critical areas of the legislation and how to apply them correctly to your business.

The difference between IR35 & Off-payroll

Firstly, it's essential to understand that the much-maligned changes to IR35 over the last few years didn't actually replace IR35 or even change it. Although the new "off-payroll working rules" are often called "IR35", they are a separate piece of the legislation.

Because they co-exist, the original IR35 rules still apply in specific scenarios, so understanding who does what is more important than ever.

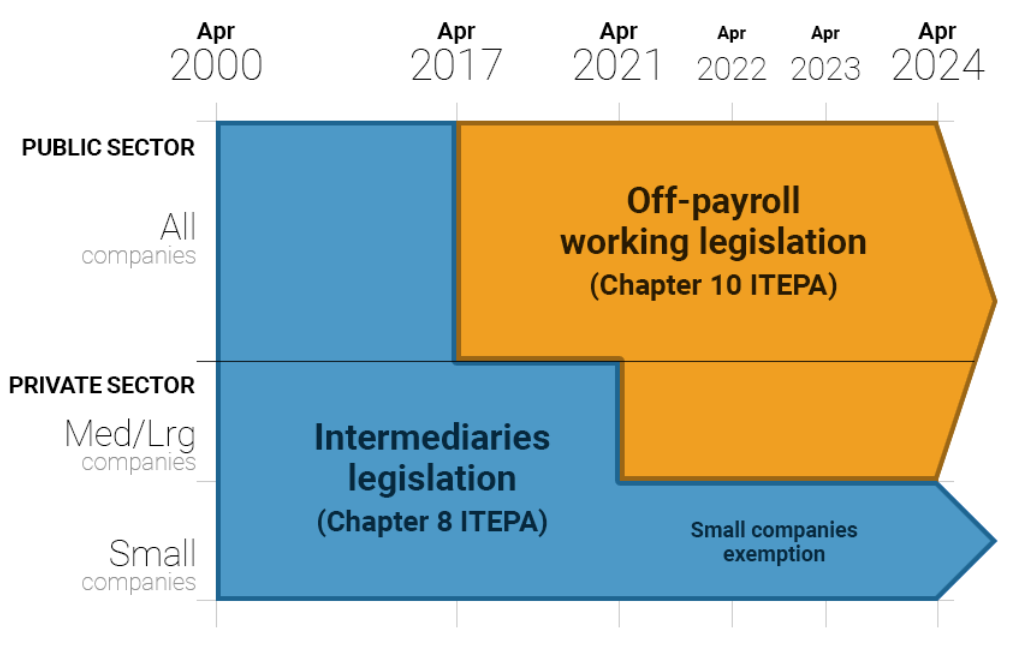

Here is the evolution over the years:

- April 2000: Introduction of the Intermediaries Legislation (IR35)

- April 2017: Off-payroll Working (OPW) rules implemented in the public sector

- April 2021: OPW extended to medium and large private sector companies

This timeline creates two distinct zones: the "blue zone" (original IR35 rules) and the "orange zone" (newer Off-payroll working rules). Understanding which zone applies to your situation is critical for compliance and determining tax liability.

How do you know which part of the legislation applies to your business?

To understand which zone applies to your business and, therefore, where your tax liabilities sit, businesses must ask themselves three key questions:

- Is there an intermediary?

- Who is "the client"?

- What size is "the client"?

Let's address each of these questions in detail.

Question 1. Is there an intermediary?

An intermediary is typically a limited company (sometimes called a Personal Service Company or PSC) or partnership where the worker has a material interest, such as shares. IR35 or off-payroll becomes relevant when a contractor is working via an intermediary.

As such, sole traders are unaffected by IR35 or off-payroll, as they engage directly with their customers without an intermediary. While similar tax risks exist for hiring sole traders, they are covered under different legislation.

Question 2. Who is "the client"?

Identifying "the client" is crucial in determining which rules apply, which party is responsible for the assessment and who has the tax liability.

The statutory definition states that "the client" is the entity to whom the worker is providing personal services:

61M(1)(a) states: an individual ("the worker") personally performs, or is under an obligation personally to perform, services for another person ("the client").

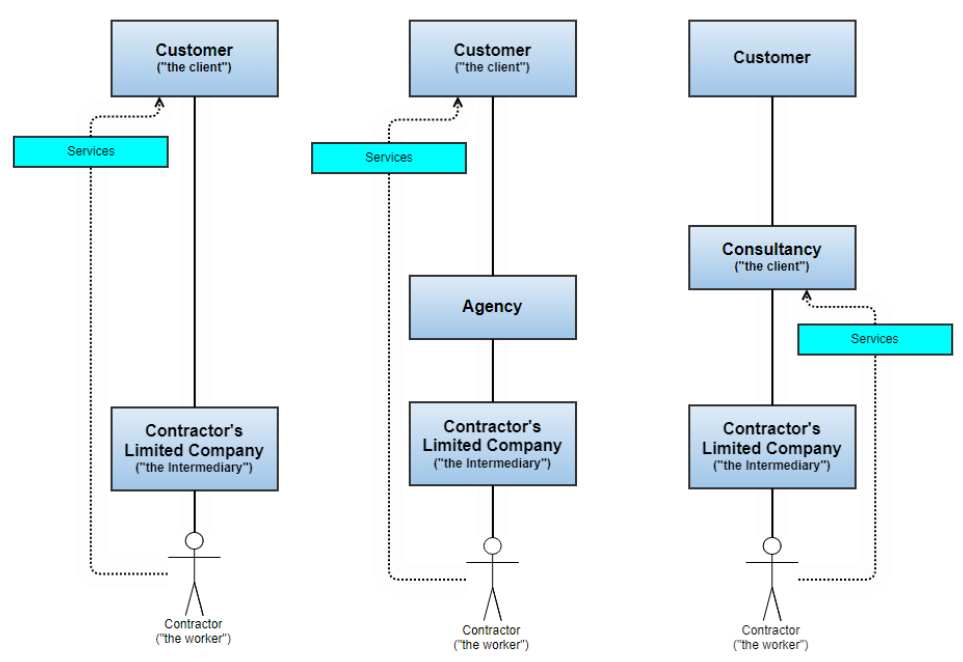

Let's consider three standard engagement models (from left to right):

Direct contract: When a contractor's company has a direct contract with their customer, the customer is "the client".

Agency involvement: If an agency introduces the contractor's business to the end customer, the agency is not considered "the client". The end customer remains "the client" in this scenario.

Consultancies: When a consultancy is responsible for delivering a fully contracted-out service, the consultancy becomes "the client". This structure differs from an agency scenario, as the consultancy takes responsibility for the deliverables rather than providing skilled individuals.

NB. Recruitment agencies are not "the client" under the IR35 or Off-payroll rules. Additionally, if a consultancy provides "warm bodies" without responsibility for deliverables, they are likely to be treated for tax purposes like an agency (or "employment business"), with the end customer remaining "the client".

Question 3. What size is "the client"?

You need to establish the business size of "the client" (as described in the above section), as this determines which part of the legislation applies. Small companies in the Private sector are exempt from off-payroll, making IR35 (the original rules) relevant instead.

To be classified as "small", a company must meet at least two of these criteria:

- Annual turnover of £10.2 million or less

- Balance sheet total of £5.1 million or less

- 50 employees or fewer

These generous thresholds allow many businesses to remain in the "small" category for an extended period, especially if they maintain a lean employee base and manage their balance sheet carefully.

Which rules apply – who is liable?

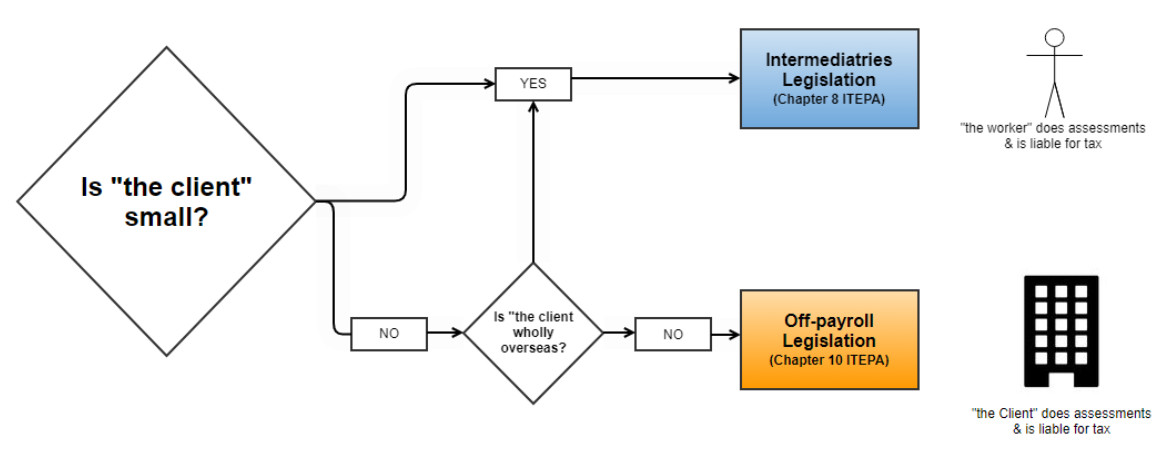

Now that we've addressed the three key questions, we can determine which rules apply. It's crucial to accurately determine which zone applies to your situation because it directly impacts compliance requirements and potential tax liabilities.

SCENARIO A [There's an intermediary, and the client is small]:

- Blue zone (original IR35 rules) applies

- The contractor is responsible for status assessments and liable for any tax due.

SCENARIO B [there's an intermediary and "the client" is medium or large]:

- First, check if the client is overseas.

- If so, blue zone rules apply (contractor is responsible)

- If the client is UK-based, orange zone (OPW) rules apply

- The client is responsible for status assessments and potentially liable for tax

NB: Recruitment agencies are never "the client" under the IR35 or Off-payroll rules. Where there is an agency in the chain and a valid SDS has been given to the worker, the agency is liable to pay any relevant taxes.

Conclusion

To confirm where your IR35 responsibilities lie in any scenario, start with the following:

- Understand your chain.

- Identify if there is an intermediary.

- Identify "the client" and its size

- Determine which party holds the responsibilities for payment of taxes and assessing status.

- Implement an IR35 assessment process into the business.

Key learning point:

Under the newer off-payroll rules (the orange zone), medium- and large-sized clients should be conducting IR35 assessments to determine the status of their contractors.

Book a free consultation today to learn how to implement a good IR35 compliance process.